When one thinks of the term conversion as it’s used in Real Estate, one of the first thoughts that may come to mind is that of converting multifamily apartments to condos. As prices continued to appreciate during the years prior to 2007, there were numerous conversions that yielded far better returns ‘by the piece’ than as a ‘whole part’. When values soon thereafter began their rapid downward descent many of those property owners were faced with making mortgage payments on a property whose value was far less than what they now owed and/or paying monthly Homeowners Association dues. The combination of weakened buyers coupled with fractured Associations is just one of several components that have contributed to home ownership being at its lowest level since 1995. As a result of decreased home ownership (64.8% in 2014) the rental market has seen increased rents throughout most of its segments. In the Portland, OR metro area rents have increased by 5% in the last 6 months with Downtown rents typically going for $1.82 per sq. ft. & NW Portland rents spiking to $1.61 per sq. ft.

The overall market is certainly stable & it appears that we’ve been out of that downward spiral long enough that we can now look to the future with some degree of confidence. In most areas, we’ve made it back from the ‘bottom of the market but, depending upon location the gain may be very slight. It would be easy to simply suggest that location has almost everything to do with the recovery or lack thereof…after all Real Estate is all about location. Some of the causes & fixes to those issues still linger and can either hinder or help investors in the current market. It’s some of the residual effects of that down market that we can reflect on to examine strategy going forward & incorporate some ideas that may have been ‘shelved’ along the way.

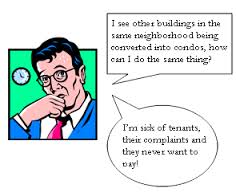

Although not a new concept by any means the conversion of a Condo Association back to rental apartments & potentially being marketed as such has never gone entirely off the landscape. Frankly, in addition to such conversions being done for a very long time, it wasn’t until I had the opportunity to weigh the needs of two entirely different clients that I decided to investigate not only why certain market factors affected values but, how & when it might be appropriate to think slightly contrary to what the market is doing. The client who initially inquired about values within his small condo complex being somewhat lower than similar neighboring complexes understood that having lost FHA certification when the ‘do over’ button was hit and everyone had to re-apply & subsequently not being able to qualify again was a factor, as was a self-imposed limitation placed on selling to investors. With values still slightly below 2007 levels, this client has purchased a 2nd unit with an eye towards slow & steady appreciation, as well as the possibility of gaining enough control in the Association with future purchases that might allow changes that will make the units more marketable, such as allowing a limited number of rentals. Certainly, a long-term outlook at what appears to be the ‘bottom’ of the market for this complex seems to be a good strategy. In the event, this client’s goals are met in regards to owning a majority of units and making positive changes I wondered how that picture might look if this particular complex were converted to a Multifamily rental property under his ownership. Of course, by the time he might own enough units, the market could have an entirely different landscape than it has now but, I couldn’t help wondering how my Multifamily buyers, who are experiencing a severe shortage of inventory, might view this property today & how that use compares to its present use.

At their current market values, owners are typically seeing sale prices around $70,000 throughout this 11-unit complex thus, an aggregate total of $770,000. Based on current market rents @ $895 each this property would gross $118,140. With a 5% vacancy factor (our area at present is ranging from 2.2% to 3.4%) plus 40% in expenses ($44,893 Proforma) we would have a net operating income of $67,340. At present, the Portland, OR metro area is seeing CAP rates of 6.7 for properties in this category thus, it would be marketed at $1,000,000.

Obviously, it’s not a simple task to dissolve an Association nor should it be done without the guidance of an Attorney & C.P.A., both with HOA experience. Having an understanding of By-Laws and how to navigate the process smoothly, especially dealing with remaining owners, is something that should be taken into consideration long before the situation presents itself…again something your Attorney can guide you with. Disbursal of Reserve funds and all the detailed accounting, including compliance with I.R.S. regulations are issues best left to your C.P.A. Like most other financial ventures you should be long on both education & the execution of those ideas, it’s my goal to act as a resource for my clients and give them a foundation upon which to carry forward their own investment strategy. As I mentioned previously, it’s difficult to tell what the market may look like several years from now but, there has always been room for successful investments in up or down markets.

Having the resources of seasoned professionals at the ready, in addition to over 20 years of assisting investors to exceed their financial goals are just a few reasons to contact me today!

Bob Zawaski G.R.I.

Oregon Licensed Principal Broker / Owner

Investors Trust Realty

www.iTrustRealty.com