You’ve decided it’s time to buy a new home however, you have a home you need to sell in order to do that, or at the very least want to minimize the carrying costs & uncertainty about locating your next home in the interim…how do you manage transitioning between houses ?

Do you sell your house first, then hopefully find the next one or do you find your next home & hope you can sell your current home quick enough to close simultaneously on your next one ? We’ll discuss everything in between, including the current Portland metro area market & what factors you should consider along the way so, let’s begin…

One of the most important things to understand is that in most cases your probably moving to improve your quality of live to some degree and have envisioned what life will be like in your next home. With that picture in mind, there is no need to distort that vision by creating undue stress thus, remember why your doing it and that it’s a choice & most likely not a necessity. Of course, there are situations that life can dictate to us such as failing health, employment changes or a need to create a multi-generational household but, despite the importance of the need to do so, all the information contained herein is equally applicable to your situation.

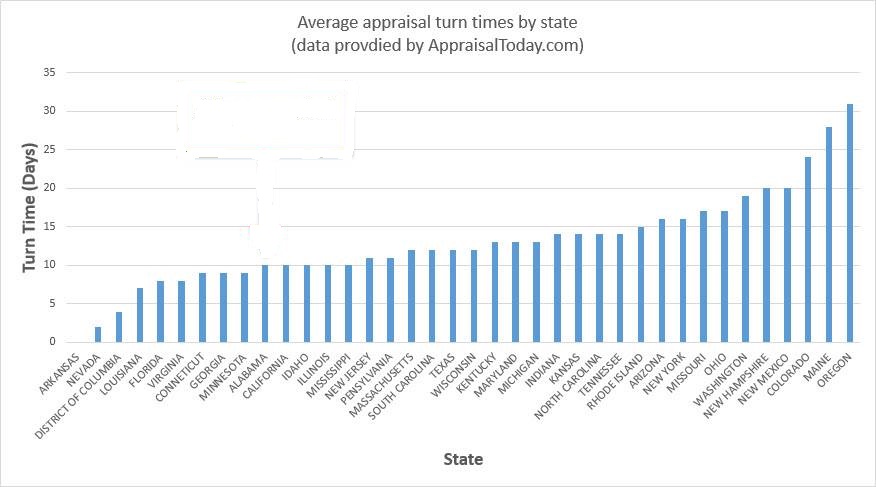

Once you’ve decided your going to make the move & have weighed the pro’s & con’s, including how it might effect your situation if you didn’t make the move, your next to step should be to develop a level of comfort as to what’s reasonable to expect as far as making your next purchase. In our current market there is just a mere 1.9 months of inventory available as of September 2015’s Market Action published by RMLS. That may bode well for Seller’s however, it creates challenges for buyer’s thus it’s important to start thinking about things as a buyer does. In many areas in and around the Portland metro we are seeing rapid appreciation & multiple offers however, that is slowing just a bit as winter approaches and where you may be looking may paint an entirely different picture. In addition to preparing your finances for that next move via providing your lender with updated information, it’s important to note that even though you may have purchased just a few short years ago that the landscape is ever changing thus you can never start that process too soon. The most pressing concern buyer’s have is ‘what will my new payment look like’ however, that may not even be a consideration if there is nothing to buy. The comfort level an individual requires varies on many fronts, with no two people being exactly alike. Typically, I would suggest that as part of this process of ‘easing’ into this next phase of life scenario that we spend ample time looking at not only new listings (if they are available) but, sale fails & recently sold properties as well. With so little to choose from it’s crucial that you have a realistic view of the overall market, including what & why certain houses sell, as well as for how much. What we don’t want to do is give away everything that you may have just made on the sale of your house (or will potentially make) by proceeding on emotion rather then with as much knowledge of how the market’s been behaving. We want to have a thorough understanding of the market before entering into it, as hesitation based on a lack of preparedness or spending too much based on pure emotion will produce poor results. How long does this process take ? It obviously depends upon the individual but, when taking into consideration the preparation of a home to sell I’m typically seeing clients starting the conversation anywhere from a month to 6 or more months out. It’s never too soon to start your on line search to help develop that comfort level & no better place to start then here.

Once you’ve determined how much your new mortgage payment will be & whether or not what you hope to find does exist, even if only for sporadic periods, then your most likely looking for anyway possible to avoid having dual mortgages in place, assuming you would qualify to do so. Since you are now wearing two hats, one as a Seller & the other as a buyer, you should be able to better understand where a buyer who is purchasing your house or Seller you are purchasing from are coming from. Again, with just 1.9 months of inventory we are in a Seller’s market, assuming the property is priced correctly and has been prepared for market so as to appeal to buyer’s. The likelihood that you would consider an offer on the sale of your house that is contingent upon a buyer’s home selling i.e., a Contingency Offer, is pretty slim, unless of course you had no other offers but, that would also mean you have an issue that has made your property something other than what could be defined as being a “Seller’s Market Property”. If, as a future buyer, your first choice is to make offers contingent upon the sale of your property you should consider that first, it’s highly likely to not get accepted if the house has any sort of activity on it. Second, most Seller’s, or at least their Broker’s if they are providing good counsel to their Seller’s, would expect a Contingency offer buyer to pay a price premium for coming off the market for the uncertainty of a transaction that may never close. After all, Contingencies are things which may or may not happen, just like in everyday life. Again, as mentioned previously the goal should be to not give away what you may make via the sale of your house. Last, although not always the case you should consider that in a market where most homes are selling fairly rapidly that if a Seller is willing to entertain a Contingency offer you should be diligent in your efforts to understand why and that’s where your Broker can be most helpful in possibly attaining information you might otherwise not be able to gather on your own. There are obviously unlimited terms & conditions that could be added to any offer that could ‘sweeten’ the pot, including those made in concert with a Contingency offer however, that too is most likely subject to your Buyer’s Broker uncovering some pertinent fact and/or being able to articulate a certain need that a Seller appears to have based upon communications with a listing Broker. It’s not a given that a Contingency offer can ever be entirely ruled out as it depends on the individual circumstances surrounding each & every transaction & there are no two that are exactly the same.

The likelihood of a Seller accepting your Contingency offer is fairly slim so, how about negotiating a lease back on your current house while you search or wait for the 2nd house to close ? Just as was the case with individual circumstances surrounding each & every transaction not being exactly the same, as mentioned in regards to Contingency’s, it all depends on being able to understand your current situation well enough so as to not give anything away for the convenience of being able to stay over. Depending upon the amount of activity you may have on the sale of your current home your Broker (and ideally it’s the same Broker who will represent you in the purchase of your next property) may be able to gauge just how far you can push potential buyers in a multiple offer scenario so as to suggest that in addition to price, their getting accepted may hinge upon a limited lease back of the property to the Seller. Unless that buyer is paying cash (actually about 35% of sales are currently all cash) or via a non-owner occupied investors loan that buyer may be limited to do such a rent back for no more than 30 days based upon conditions of their loan. In addition to the aforementioned limitations, specifically those of buyer’s with owner occupied financing (the majority), a Buyer’s Broker who is providing thorough counsel to their buyer clients may convey that a Seller stay over has some potential liability that the buyer should consider thus, it may eliminate some or all of those potential buyers. The current Oregon Sales agreement (O.R.E.F. 054) does address in much greater detail then we would venture into here the terms & conditions under which each party is responsible for certain acts & costs etc., however, despite it’s best intentions over (4) pages there will always remain issues that will require additional deliberation, either by a Court or perhaps an insurance carrier. Point being, any attempt to stay over as a seller in order to easily transition into a purchased property may eliminate potential buyer’s who might bring the best offers thus, another scenario wherein your Broker can advise you.

What about those who would gladly carry (2) mortgages for a brief time but, aren’t able to qualify to do so ? Bridge loans have existed for a long time however, even in the boom market in the late 90’s and into the early 2000’s it was no secret that the costs were prohibitively expensive. With rates in general being lower then in the past the Bridge loan looks less attractive by today’s standards.

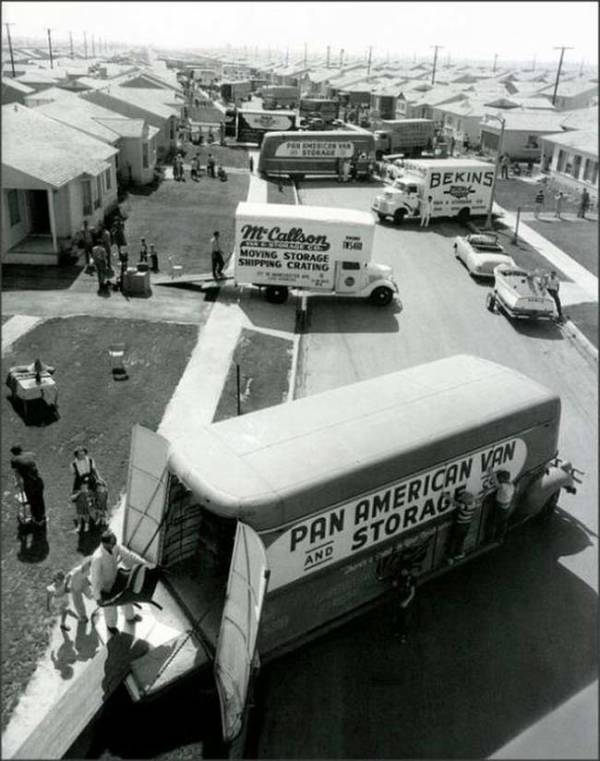

Although not practical for everybody hoping to transition from being a seller to a buyer, having a stopping point in between i.e., a rental property, allows for optimal strength on both sides of buying & selling. As a seller you have the flexibility in moving quickly from your property which some times can be looked upon favorably by a buyer who may pay a premium in price for the convenience. In addition, it allows you as a Seller the opportunity to slowly & methodically remove personal possessions from your home to better stage it for sale. From the buyer’s side of the equation you have the flexibility a seller might be looking for when deciding which offer to accept, moving quickly on a vacant house or perhaps a longer escrow where needed. Having your offer accepted is not entirely about price and having some flexibility and a verified down payment waiting makes your offer more attractive to a seller.

With home ownership being at historically low levels it’s created a very competitive rental market thus, it’s not just homes for sale that are in short supply. The vacancy rate in the Portland, OR metro area is 2.5% at this time thus, you might disregard much of what I mentioned in the last paragraph about the possibility of renting in between. Typically, the initial response from clients might be one of dismay at the idea as they see the same difficulties in finding a short term rental as they do in finding their next house. In most cases this because they are looking at traditional rentals wherein the landlords are looking for long term tenants with terms & deposits etc. that are not geared towards shorter stays. With all the rentals that should be available due to record low home ownership why would vacancy rates be as low as they are ? In many cases those investors have ventured into shorter term rentals where regulations allow and have been able to get premium returns as a result. Programs such as VRBO, AirBnB & FlipKey have opened up short term housing in local areas throughout the Nation & Worldwide. There are numerous spin off websites in our area with similar rental opportunities that are priced competitively with local long term rentals, yet without the large deposits & other conditions we would hope to avoid that are common to traditional long term rentals. I sold several properties this year alone that will be used for short term rentals.

As is the case with every Real Estate transaction being different in their own way, the answers to your particular needs & requirements may require a combination of some or all of the ideas put forth in this blog.

Best Regards,

Bob Zawaski G.R.I., e-Pro

Oregon Licensed Principal Broker / Owner

Investors Trust Realty

Bob@iTrustRealty.com

www.iTrustRealty.com